During the spring the ECM Research & Statistics Working Group conducted a survey among the 120 member destinations in order to monitor background variables of product sales and to monitor the development of online sales. The results were presented at the Annual Conference in Las Palmas, 9th – 12th June, which focused on social media and the “hot” topic of if it really delivers revenue for DMO’s and CVB’s.

\n

Background and purpose

\n

The aim of the survey was to provide a quick overview of the current situation and to add information to the recent discussion concerning new consumer behavior when buying touristic products; more and more is done on the internet. It is obvious that new actors (i.e. Tripadvisor.com, Expedia.com, Hotels.com etc.) have entered the market, and there is a widespread perception that they have caused tourist organizations to lose business.

\n

\n

Respondents

\n

The survey was sent out to all members of ECM, representing 120 destinations in total. The survey was answered by 39 organisations, representing 36 destinations. The organizations defined themselves as CTO’s 54%, CVB’s 15%, DMO’s 13% and 18% “Other” – mainly regional organisations.

\n

\n

Some of the questions were answered by so few respondents that the quality of the conclusions is questionable. Therefore, this article will focus on information found in questions with a higher sample size.

\n

\n

What products are offered online?

\n

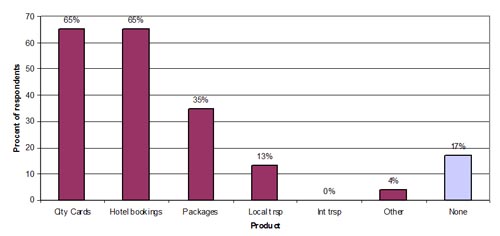

“Products” were defined as touristic products; city cards, hotel bookings, packages or transportation. More general products such as advertising space or merchandise were excluded from this survey.

\n

\n

Touristic products offered online

\n

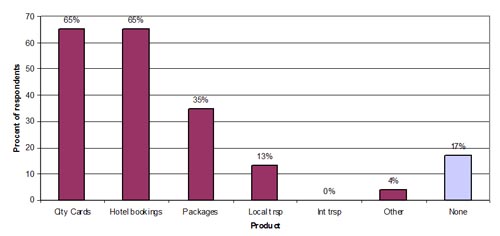

The chart shows that 65% of the respondents offer city cards and hotel bookings online – those are the most frequently offered products. “Other” products are mostly specialised or local products such as guided tours or ski passes. 17% of the respondents do not offer any products online. The survey also examined what products are offered by the respondents in any channel. When comparing that overview to the online chart above, we can see that “Other” products and local transport tend to be offered to a lesser extent online. This may suggest that standardised products are more suitable for online sales.

\n

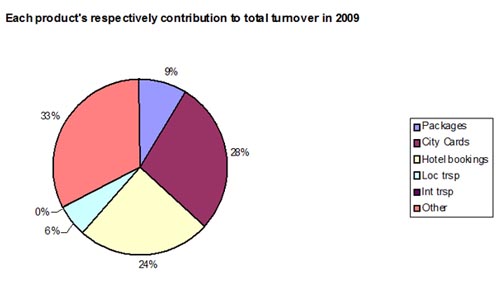

How important is each product to the responding organisations? The chart below shows to what extent each product contributes to the total turnover of sales. The percentage is a mean of all answering organisations’ estimates.

\n

\n

\n

Economic performance 2006-2009

\n

The survey covered the turnover development of total product sales between the years 2006 and 2009. The result shows a 41% increase over the years, but the sample size was so small (9 answers) that that result can hardly be considered representative for all ECM destinations.

\n

\n

This was also the case when asking for the profit development of total product sales over the years 2006-2009. The index curve 100-126-90-91 indicates a 9% decrease in 2009 compared to 2006. In this case the number of answers was just five, which really should be taken into consideration.

\n

\n

Measured by share of total product turnover, online sales – compared to “traditional sales” in other “usual” channels – seem to have increased over the years, from 17% of the total turnover in 2006 to 36% in 2009. Again, in this case this can’t be considered statistically significant as the sample size again was small.

\n

\n

Comments on significant changes

\n

Here are some respondents’ comments on significant changes in sales between the years:

\n

\n

• Losing market share on last minute desk hotel reservations since 2001, gaining marketshare on City cards, main online sales growth is generated in online sales of the Citycard.

\n

\n

• We registered a dramatic drop from 2008 to 2009.

\n

\n

• The overall downward trend from 2006 is due to changes in customer behaviour and tough competition from other and new actors. The turnover of sales and profit is less, but the number of visitors is increasing every year.

\n

\n

• The city card as a product has lost its appeal. A city transportation ticket can be seen as a big competitor.

\n

\n

• Currently, it is very important for us to offer all these services online given the changes in tourism demand which see hotels/tourism services booked online more and more.

\n

\n

Social media in use

\n

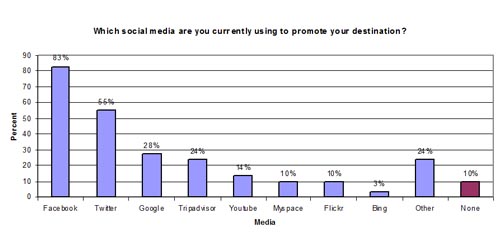

The chart shows which media the responding ECM members are using. Facebook is the most popular, used by 83% of the respondents. 10% of the respondents use no social media. It should be stated that different media are used for different purposes, with shifting inputs from the tourist organisations; some are paid advertising, and some are social networks demanding involvement and time.

\n

\n

\n

\n

Plans for the future

\n

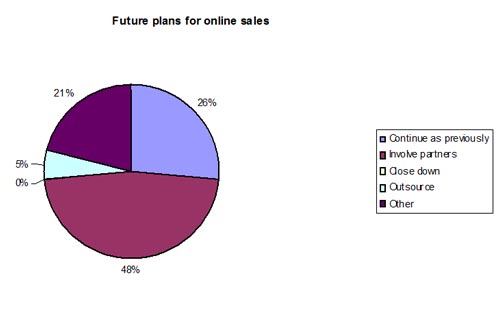

How do respondents plan to proceed with online sales in the future?

\n

\n

\n

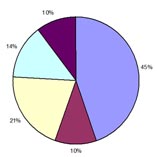

Most respondents (48%) intend to involve partners, 26% plan to continue as previously and 21% have “other” plans. Only 5% will outsource online sales to other actors. It is good news that no organisation intends to close the business down.

\n

\n

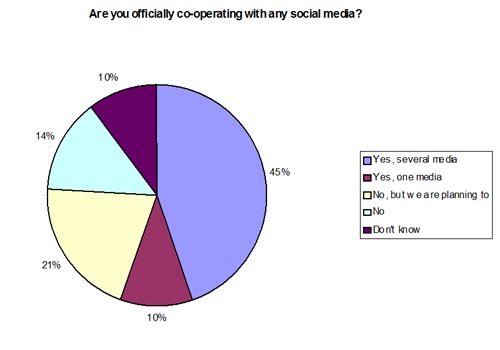

The survey also investigates the respondents’ thoughts about closer co-operation between the respondent organisation and social media, i.e. if the organisation is willing to allow a form of social media to be directly accessible from its own webpage. This is the distribution of results:

\n

\n

\n

\n

Further research

\n

Judging from the lively discussions during the conference in Las Palmas this really is a “hot” topic and more information may be required. If so, the ECM Research & Statistic Working Group would be glad to conduct another survey, perhaps with a slightly different approach to stimulate a higher level of participation and more significant results.

\n

\n

\n

\n

Henrik Jutbring

\n

Research & Statistics, Göteborg & Co

\n

\n

\n

\n

\n