European City tourism to resume positive growth in 2014, bolstered by international bednights and the recovery of traditional markets

European Cities Marketing (ECM), the network dedicated to increase competitiveness and performance of leading cities in Europe, releases its annual ECM Benchmarking Report later this year. Preliminary figures for 2014 indicate positive increase in bednights hosted by European cities with an impressive intensification of the Chinese market and the recovery of long-established source markets like Italy or Spain

Comparative data for an initial sample of 63 cities shows 4.3% increase in international bednights since 2013. International bednights continued to grow at a faster year-on-year grow rate than domestically-sourced nights (+4.3% vs. +2.9% respectively), representing just over 65% of total bedights (235.1 million in 2014). The European Cities Marketing Benchmarking Report, the reference for urban tourism in Europe is to be available next June and will show data of more than 110 cities.

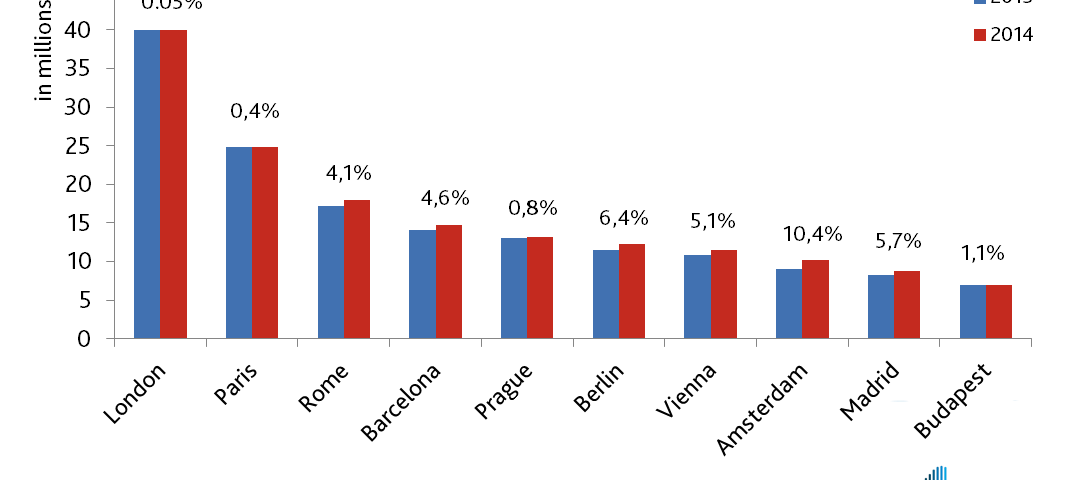

London and Paris once again claimed the highest number of international bednights with small positive increases over the previous year. Other top ten cities made more notable leaps in internationally-sourced bednights; four of the top ten cities hosted between 4% and 6% more international bednights since 2013, while Berlin showed impressive growth by 6.4% and Amsterdam greatly increased international bednights by 10.4%.

The USA, Germany, and the UK provided nearly a quarter of the international bednights spent in European cities in 2014. Each of these source markets increased by between 4-6% since 2013. Spain and Italy resumed positive growth rates as source markets after continual decreases in number of bednights spent in European cities over the past few years.

The 2013 star growth market, China, showed impressive growth by 13.2% in 2014 to make up about 1% of bednights spent in European cities. In 2013, the Chinese market was already growing by 11.4%.

Japan, however, continued to show a decline in bednights since the previous year (-4.1%) and Russia decreased even more with -7.9% after having grown by an impressive 9.4% in 2013. The decline of the Russian source market was expected due to the decrease in the oil prices, devaluation of the ruble, and sanctions taken against Russia because of the country’s conflict with Ukraine.

“These results provide crucial insights into European city competitiveness and competitor sets”, declares Ignasi de Delàs, President of European Cities Marketing. He continues: “Internationalisation is one of the key-words in the tourism-development of many countries. The ECM Benchmarking Report clearly shows that the continuous success of city tourism in Europe is based upon a rich mix of source markets.

In 2014, international bednights grew about 1.9 times the rate of domestic tourism growth in European cities. Bednight numbers representing tourists from China, one of the BRIC markets, are still growing tremendously over the previous year. However, with an average of 65% of international guests, European cities can cope with negative growth of markets like Russia or Japan, thanks to the recovery of the Spanish and Italian markets.

Despite all economic or political factors, it is proven that the cities’ strategic focus on international visitors is the main reason for the triumph of the cities, which gives City Tourism Managers every reason to be confident in the strength of the European tourism industry.”

European Cities Marketing, the network of leading city tourist offices, convention bureaux and city marketing organisations, reports on the state of the European tourism industry with its annual issue of the ECM Benchmarking Repot. Data is provided by the cities themselves and compiled by MODUL Research. Early data from a sample of 63 cities show healthy overall growth in the European city tourism industry.

The 11th edition of the annual European Cities Marketing Benchmarking Report will be presented during ECM Annual conference in Turin on June 3-5, 2015 and will be available on dev.europeancitiesmarketing.com.

If you are interested in further information about the ECM Benchmarking Report, would like to join the annual conference, retrieve latest data on the development of European Cities or quarterly predictions of Europe’s tourism professionals on the expected tourism performance, please get in touch with Flavie Baudot from European Cities Marketing.

*ENDS*

* European Cities Marketing is a non-profit organisation improving the competitiveness and performance of leading cities of Europe by providing a platform for convention, leisure and city marketing professionals to exchange knowledge, best practice and widen their network to build new business. European Cities Marketing is promoting and linking the interests

of 110 members from more than 100 major cities in 36 countries.

Contact information

European Cities Marketing, 29D rue de Talant, F-21000 Dijon. Tel: +33 380 56 02 04

Flavie Baudot, press@europeancitiesmarketing.com, +33 380 56 02 00

Ignasi de Delàs, President, president@europeancitiesmarketing.com

* MODUL Research is a subdivision of MODUL University Vienna that aims to bridge the two domains of basic and applied research. MODUL Research engages in research projects that provide workable solutions to problems that private firms, industry associations, groups in civil society, and governmental organisations have identified as important.

Contact information

MODUL Research www.modul.ac.at/research/modul-research-gmbh/

Prof. Karl Wöber, President, karl.woeber@modul.ac.at